GEMS Medical Aid Options: A Clear Guide to Dental Cover

Choosing the right medical plan means more than just hospital cover – dental care can have a big impact on your health and your budget. If you’re researching GEMS medical aid options, this guide explains how dental benefits typically work, what to look for, and practical tips to get the most from your cover.

What dental cover usually includes

Under most gems medical aid options, dental benefits are offered in different forms and levels depending on the option you select. Common elements include:

- Preventive care: routine check-ups, cleanings, and fluoride treatment.

- Basic restorative care: fillings and extractions.

- Major restorative procedures: crowns, root canals, and dentures (often subject to limits).

- Emergency dental treatment: urgent care for acute pain or injury.

- Orthodontics: sometimes included for children, often as a separate benefit or waiting period applies.

Benefits and limits vary between options, so it’s important to compare what each GEMS medical aid option provides for dentistry.

How dental benefits are structured

Dental cover under gems medical aid options is typically structured in one or more of the following ways:

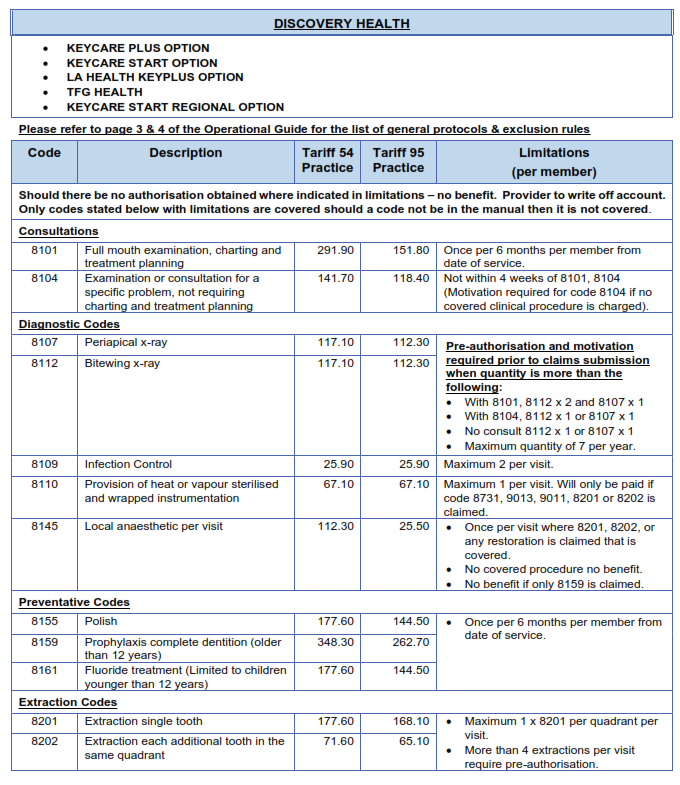

- Annual limits: a set monetary amount per beneficiary or family for dental procedures per year.

- Sub-limits: specific caps for categories like restorative or orthodontic care.

- Network vs. non-network providers: using an approved dental network may reduce your out-of-pocket costs.

- Co-payments and authorisations: some procedures require pre-authorization and a co-payment may apply.

Understanding these structures will help you avoid surprise bills and make informed choices about care.

Choosing the right GEMS medical aid option for dental needs

When comparing GEMS medical aid options for dental cover, focus on these key questions:

- What is covered under preventative care and how often?

- Are major restorative procedures included or excluded?

- Is there a separate limit for orthodontics or prosthetics?

- Do I need to use network dentists to get full benefits?

- What are the waiting periods before specific dental benefits kick in?

If you or your dependents need routine dental care and occasional restorative procedures, look for options with strong day-to-day benefits and reasonable annual limits. If you anticipate major work (crowns, implants, orthodontics), prioritise options that include higher dental sub-limits or supplementary cover.

How to maximize your dental benefits

Make your dental budget go further by applying these practical tips:

- Prioritize preventive care: regular check-ups and cleanings prevent costly treatments later.

- Use network providers: they often bill the scheme directly and charge negotiated rates.

- Get treatment plans authorised: for major procedures, an authorization avoids rejected claims.

- Keep accurate records: receipts, treatment plans, and referral notes streamline claims.

- Plan treatments across benefit years: if you’re approaching an annual limit, discuss timing with your dentist.

Common pitfalls to avoid

A few frequent mistakes members make when assessing GEMS medical aid options:

- Overlooking waiting periods for major dental work.

- Assuming all dentists are treated equally — non-network prices can be higher.

- Ignoring sub-limits for specific procedures (e.g., crowns or orthodontics).

- Not confirming whether emergency dental treatment is covered outside normal hours or when traveling.

Read the option-specific rules and the scheme’s dental benefit schedule carefully before committing.

Final checklist before you decide

- Confirm what dental services are included and the annual limit.

- Ask about network providers and whether your current dentist is in-network.

- Check for waiting periods on major treatments.

- Understand pre-authorisation and co-payment requirements.

- Compare premium differences versus expected dental needs.

If dental cover is important for you or your family, weigh the value of stronger day-to-day and dental benefits against any additional premium. For many members, a slightly higher monthly contribution can save money over time by reducing out-of-pocket spending for routine and restorative care.

Next steps

To compare GEMS medical aid options accurately:

- Review the scheme’s latest benefit guides for exact dental limits.

- Request a written benefits comparison or speak to a GEMS representative.

- Consider consulting a financial advisor if you’re balancing cover across multiple dependents.

Courtesy of Dental Tariffs Pack